American Worker Rebate Act of 2025: Supporting Families with Rebates

- Small Town Truth

- Aug 3, 2025

- 2 min read

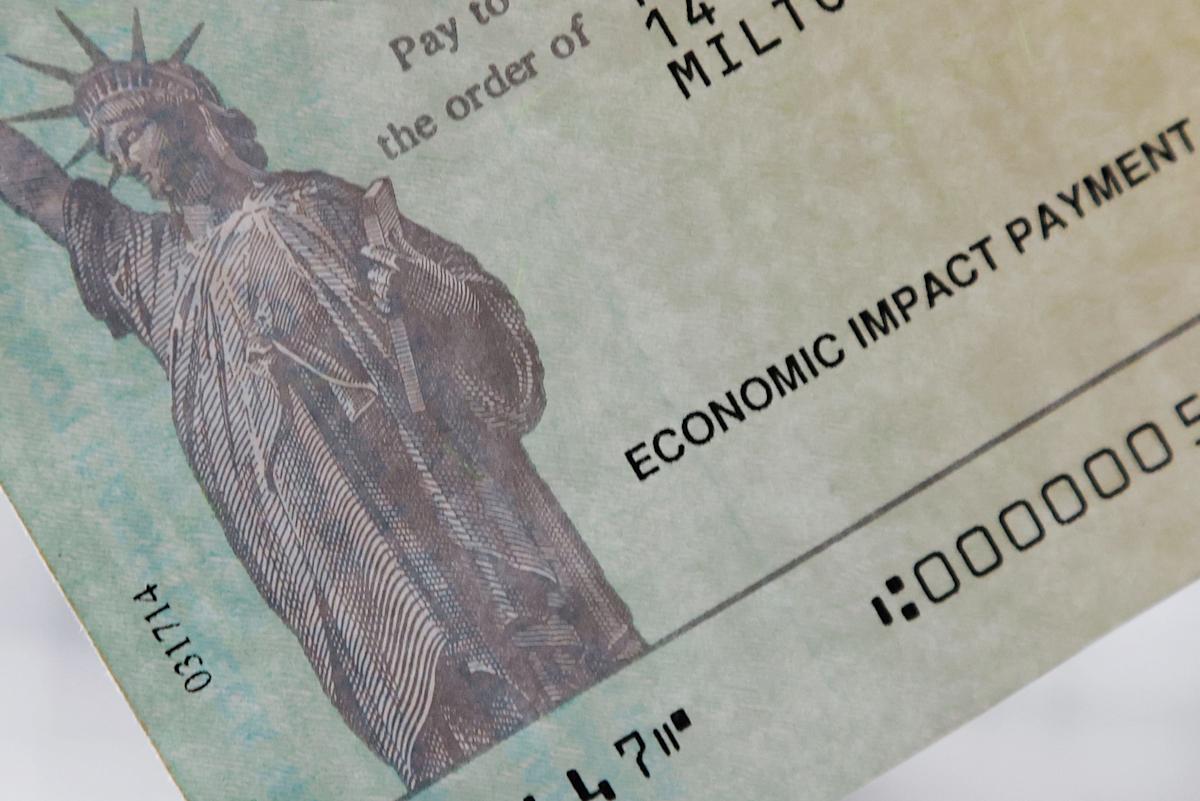

In a move aiming to support American families, the American Worker Rebate Act of 2025 has been introduced, inspired by President Donald Trump's recent comments on potential tariff rebates. This act proposes to distribute monetary benefits to taxpayers, reminiscent of the stimulus checks issued during the COVID-19 pandemic.

During a press interaction on July 25, Trump acknowledged the influx of tariff revenue and referenced the idea of providing a rebate to U.S. citizens. He stated, "We have so much money coming in, we’re thinking about a little rebate. But the big thing we want to do is pay down debt." This statement sparked discussions about the feasibility of such rebates for low- and middle-income families.

Missouri Senator Josh Hawley, shortly after the President’s remarks, introduced the American Worker Rebate Act of 2025 to turn this idea into legislation, which would facilitate direct payments to Americans.

Details of the Proposed Rebate

The proposed legislation outlines that eligible households would receive a minimum of $600 for each adult and dependent child. For a family of four, this could result in total payments of $2,400. However, the rebate will diminish by 5% for joint filers whose adjusted gross income exceeds $150,000, and for individual filers earning more than $75,000.

Economic Context and Revenue Generations

Recent analysis from The Budget Lab at Yale highlights that households in the U.S. could incur an average cost of $2,400 in 2025 as a result of higher prices from increased tariffs. In a different financial context, the U.S. Treasury reported a surplus of $27 billion for June, a recovery from a $316 billion deficit in May. This revenue surge is attributed to customs duties, which reached around $27 billion for June, showing a significant increase from previous months.

Annual tariff collections so far total $113 billion, marking an impressive 86% rise compared to the prior year. The bill also includes provisions for potentially larger rebates if tariff revenues surpass government projections, emphasizing the dynamic nature of this financial initiative.

Looking Ahead

As discussions evolve, the concept of rebate checks continues to attract attention, drawing parallels to the earlier financial aid provided to citizens during challenging times. The American Worker Rebate Act of 2025 will be a focal point in legislative discussions moving forward, with its implications for both households and government revenue generation being closely monitored.

.png)