Trump's Tariff Changes Impact U.S. Consumers and Global Retail Operations

- Small Town Truth

- Sep 14, 2025

- 3 min read

As of August 29, consumers in the United States have been confronted with increased costs on imported goods due to an executive order from President Trump that abolishes the de minimis rule. This change previously allowed shipments valued at under $800 to evade import tariffs, which is significant given the volume of such purchases made daily. According to the Consumer Federation of America, around 4 million such orders were processed each day, indicating the potential impact on consumers and retailers alike.

Data reviewed from the Yale Budget Lab showed that tariffs have generated approximately $88 billion in revenue for the year thus far, with $23 billion accrued in August alone. Contrary to Trump's assertions that other countries would bear the costs of these tariffs, evidence suggests that these fees are being ultimately charged to U.S. importers, who are likely to pass on the costs to consumers.

Recent reports from consumers illustrate this point vividly. For example, one Reddit user shared their experience of being charged $54 in tariffs on a $100 jacket purchased from Japan, where $36.50 was attributed directly to tariffs and the remainder to processing fees from DHL. The user articulated frustrations about the high costs implied by the new tariffs, particularly for transactions that appeared harmless in the past.

Another case involved a $42 order from a coffee accessory vendor in Taiwan, which incurred an additional import fee of $29.25. Since most imports from Taiwan are impacted by a current 20% tariff, unexpected processing fees from shipping companies such as DHL, UPS, and FedEx may inflate the total costs considerably beyond initial expectations.

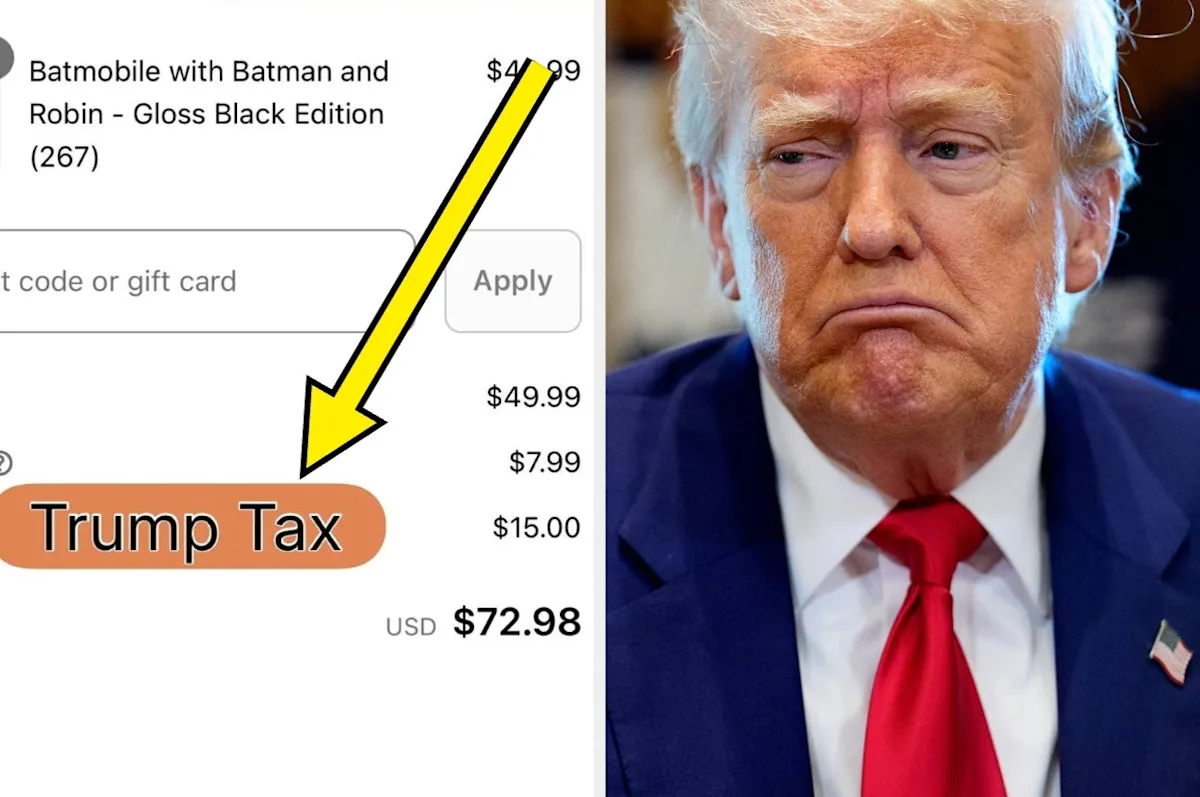

In response to these new expenses, some merchants have begun factoring anticipated tariff costs into the checkout process to prevent surprise charges for consumers. For instance, a screenshot shared by a Reddit user during their holiday shopping showed tariffs presented as “import fees” or “Trump Tax” within their shopping cart, highlighting growing consumer awareness of how tariffs are integrated into purchasing decisions.

The ripple effect of these changes has prompted over 30 countries, including prominent ones such as Australia and Japan, to cease shipments to the U.S. Some retailers have also chosen to halt shipments to the U.S. entirely, citing the impossibility of absorbing these tariffs in the long term. The retailer Funstock expressed concerns about how these costs affect their viability in the market.

Moreover, small businesses in the U.S. have been increasingly affected by these tariffs. A recent example showed an artist struggling with a UPS customs bill for just two baseball hat samples from a Chinese manufacturer, which was compounded by various tariff fees totaling several dollars alongside administrative charges.

The consequences extend internationally as well, with many small overseas businesses experiencing a decline in U.S. customer sales. A Canadian Etsy seller noted that the newly imposed tariffs had significantly deterred American shoppers, threatening the sustainability of their business.

Although Trump's tariff strategy aimed to restore American manufacturing, recent statistics reveal a decline of 78,000 manufacturing jobs this year, including a loss of 42,000 jobs since the tariffs were announced in April. Economic conditions related to tariffs, alongside rising interest rates and immigration policy crackdowns, are contributing to this slowdown.

Despite these measures intended to bolster domestic manufacturing, the trajectory appears to pose significant challenges for both consumers and businesses alike, leading many to question the broader ramifications of such economic policies.

.png)