Trump's Import Policy Shift: Tariffs Impacting Online Shopping Landscape

- Small Town Truth

- Sep 15, 2025

- 3 min read

On August 29, an executive order issued by President Trump marked a significant shift in U.S. import policies by terminating the de minimis rule. This rule had previously allowed shipments valued under $800 to bypass import tariffs, impacting the thousands of small parcels that Americans frequently purchase from online retailers. According to a representative from the Consumer Federation of America, approximately 4 million such orders were processed daily.

Recent data from the Yale Budget Lab indicates that the tariffs have generated significant revenue for the government, totaling $88 billion so far this year, with $23 billion collected in just August. Contrary to the President's assertions that foreign nations would bear the burden of these tariffs, it appears that American importers are ultimately responsible for these costs. This financial strain is expected to be transferred to consumers, radically altering the shopping landscape.

For instance, one consumer shared a troubling experience on Reddit, recounting a charge of $54 in tariffs for a $100 jacket procured from Japan. The breakdown revealed that $36.50 constituted the actual tariff costs, while the remainder consisted of DHL processing fees, demonstrating how these tariffs can skyrocket the price of imported goods.

Another example involved a $42 order from a coffee accessory company in Taiwan, resulting in an additional charge of $29.25 due to tariffs and processing fees. Most items imported from Taiwan are currently subjected to a 20% tariff, indicating that consumers may find themselves paying more than expected upon delivery, as logistics companies typically charge fees for handling these tariffs.

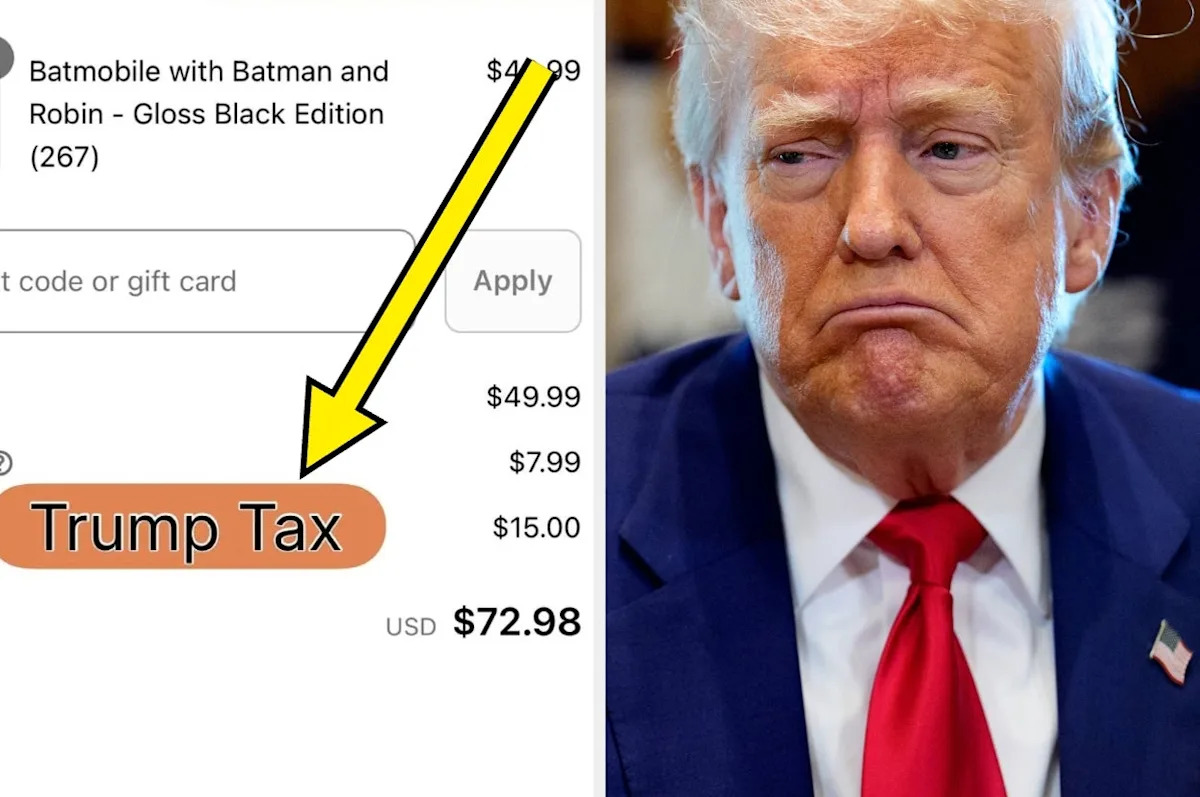

Some retailers have anticipated these increased costs, now integrating tariff fees directly into their pricing structures. A Reddit user illustrated this transition while shopping, showcasing a model car purchase that explicitly listed a “Trump Tax” in the breakdown of fees. This shift reflects a trend wherein various companies are labeling tariff-related costs as “import fees” or “duties,” while consumers continue to express frustration over the added financial burden.

The ramifications of these tariffs are far-reaching, as over 30 countries, including Australia, India, and Japan, have responded by suspending shipments to the United States. Some retailers have proactively ceased shipping to the U.S. altogether, citing the inability to absorb the heightened costs associated with tariffs. One company articulated their stance by stating that they could no longer offer shipment services to the U.S. without a viable way to manage the additional tariff expenses.

Furthermore, small business owners in the U.S. are feeling the pressure of increased tariffs. A small business owner recently shared a tweet highlighting substantial customs fees incurred while importing sample hats from a manufacturer in China, which illustrated the unexpected burden of multiple tariffs leading to higher overall expenses.

International sellers are also confronting difficult challenges; a Canadian merchant expressed concern on Reddit over decreasing sales due to the newly imposed U.S. tariffs, emphasizing that their business might not survive without purchases from U.S. customers. Others echoed these sentiments, reporting drastic revenue declines after discontinuing shipments to the U.S.

While the aim of Trump’s tariff policy was to stimulate domestic manufacturing, the outcomes have been less favorable than anticipated. According to the Bureau of Labor Statistics, manufacturing jobs have experienced a decline of 78,000 this year alone, with 42,000 of those losses occurring since the tariff announcement in April. Economic analysts attribute this downturn to factors including tariffs, restrictions on immigrant labor, and rising interest rates, leading to broader market instability.

As consumer experiences and retailer operations shift under these new tariff regulations, understanding the implications of such policies remains crucial for both buyers and sellers in the current economic environment.

.png)